MORTGAGE CALCULATOR

USAGE

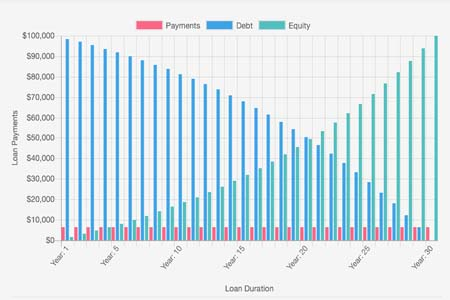

Before purchasing or refinancing a home, a Mortgage Calculator is an important tool that will help you understand and plan for a better home loan. It will assist you in understanding monthly payments, projecting how much equity will be built or how the debt will get paid off overtime.

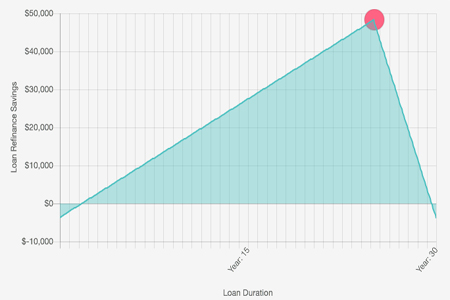

Our easy-to-use Mortgage Payment Calculator allows you to calculate various amortization periods and compare how a 30-year mortgage payment compares to the one of 20 or 15 years. It also shows the interest that will be paid over time as well as the total amount that will be paid including principal and interest. Try our Mortgage Refinance Calculator if you’re in the market to refinance your existing home loan. It will help you determine if refinancing for a lower rate will make sense, and how long it will take to recoup closing costs. Maybe you’re in the market for a debt consolidation loan to pay off high interest credit cards with a lower mortgage payment, one that would actually pay some of the principal off. Use this tool to compare current and projected mortgage rates, amortization terms, and new loan amounts.

Using mortgage calculators is a good idea even if you’re already working with a mortgage broker, as it demonstrates that you’re informed, and can make your own educated decisions. It’s ease-of-use is highly rated by real estate agents and many of them use the payment calculator as an everyday tool in consulting their clients.